The here and now

Needless to say, we live in interesting times, the evidence is all around us. Kids at home, no daily commutes to work and the odd glance at other shoppers as we all try to keep our distance.

The same goes for work, with the status quo of how ‘business is done’ being tested. Are the hours spent in lunch meetings, travelling and other high-contact aspects of business the only way business gets done, or are these just social norms that we never stopped to question?

The restriction on movement and human contact is probably the biggest disruption most of us have experienced in our lives. As with all paradigm shifts, some will find that they are well-prepared while others, perhaps caught off guard, are scrambling to find a response.

In observing various reactions to the situation, one common denominator between large firms and smaller business around the world is how quickly we have turned to technology and various forms of digital solutions. This is no different for Europe as it is Asia, the Middle East, North America or indeed Africa.

As our calendars fill up with Zoom meetings and webinars it will, of course, appear that we’ve all gone digital. However, when we peel back the surface, we should be able to see how many of the core areas of our business are digital. For some industries, such as hospitality and travel, fundamental challenges block a fully innovative approach. For others, such as financial services and investment, this situation presents a pivotal opportunity to re-evaluate how we work.

As with all paradigm shifts, some will find that they are well-prepared while others, perhaps caught off guard, are scrambling to find a response.

For example, when we look at investors and investment professionals active on the African continent, are we still able to find bankable trade and investment opportunities without the frequent flights? Similarly, are we developing business leads without networking events and conferences?

As you think through these two questions, we at Orbitt would like to provide you with three pillars – Communication, Information and Tools – to assess how digitally-ready your business is for the post-COVID world.

Communication

We are fortunate to live in an age where technology has made adapting to the current situation less painful because of the ease and availability of business communication. Zoom for video, Slack for team messaging and good old email for sharing documents are great for daily tasks, but does that make our business digital?

Webinars, which in the current environment appear to be replacing physical conferences, are another aspect of communication. They are useful sources of information and help us stay up to date on latest thoughts within various industries.

As our calendars fill up with Zoom meetings and webinars it will, of course, appear that we’ve all gone digital.

But what tools do you have for accessing intelligible data and taking an action on the information shared during the webinars?

Information

We are inundated with lots of communication, but much of that contains no useable information. There has been an improvement in Africa’s macroeconomic data through the likes of the World Bank Africa database and historic data on completed transactions from various reports. Nonetheless, investment practitioners still struggle to find actionable information on investment leads.

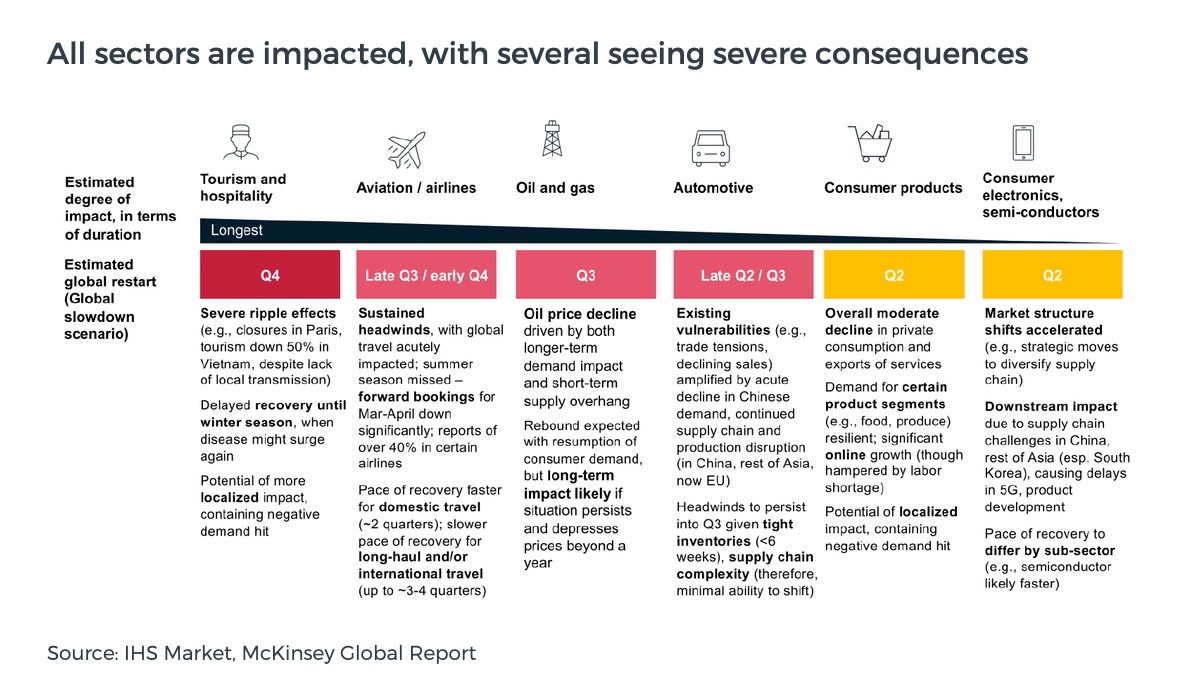

As we all brace for a recession, Africa is likely to be hit hard. Whether V-shaped, U-shaped or L-shaped, it doesn’t really matter – when demand for raw materials slumps and trade slows, certain sectors will be worse-off given the nature of this crisis. From a business perspective, entertainment and travel are two industries where we often allocate spend to.

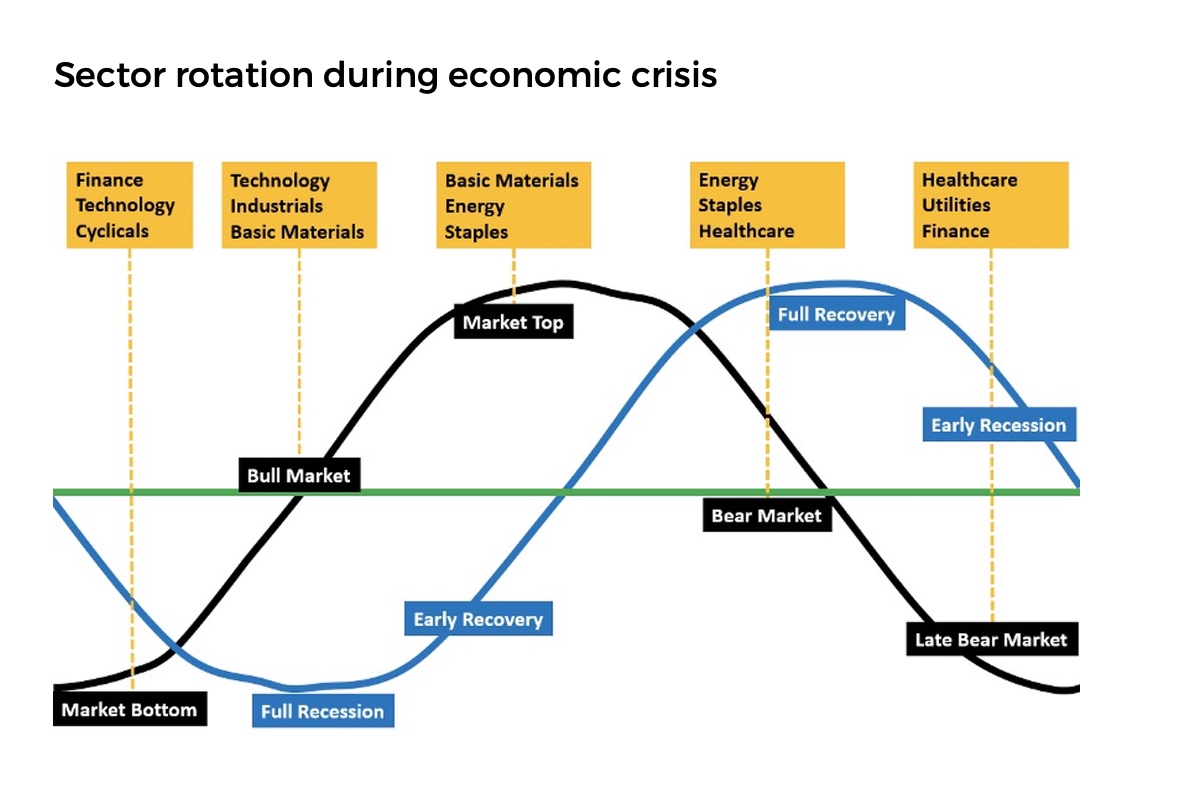

But let’s take a step back. The recent past has taught us that with recessions come new opportunities. A basic understanding of the principles of economic sector rotation tells us that certain industries will thrive during this phase. We should also know that as recovery kicks in across other sectors, this will create a new set of trade and investment opportunities.

The same logic applies to the varying degrees of economic impact and the resulting opportunities across Africa’s 54 countries. But how do you find these opportunities when sat in your back garden or home office, while telling the kids to keep the noise down?

Tools

We are uncertain of how long this situation will last or what the next major economic shock may look like. What we can be confident about is that things will no longer be business as usual. In a post-crisis world, we will need:

- new tools to adapt our businesses;

- to be more efficient;

- and ensure every dollar spent earns even more significant returns.

Tools we will need as trade & investment professionals focused on Africa include:

- Proprietary deals

Institutional investors place a lot of emphasis on proprietary deals as well as access to investable businesses that fit their investment criteria. The ability to curate your deal flow at a fraction of the cost and time previously incurred will be a key asset, more so as these deals become ever more difficult to find.

So, let’s take the recent announcement by Afreximbank to inject $3 billion in an attempt to cushion the current situation. The fund will assist member countries and provide emergency trade finance facilities for the import of medical supplies and medical equipment.

As an investor how do you find the healthcare companies across the continent that have accessed this trade fund and now need equity or debt to strengthen their balance sheet?

- New sources of transactions

We can’t be certain that deal flows will continue to originate from the same contacts or sources. You would have been forgiven for thinking that corporate finance advisers and investment banks are the primary sources of deal flow across Africa.

But we looked at data gathered on our platform between March 2017 and March 2020 across 682 Africa-related transactions (total value of $14.4 billion). Of these trade and investment opportunities, only 52% (357) were with an adviser, whilst 29% (196) were driven by the in-house finance team, and the remaining 19% (130) came from other financial services providers.

We believe that these alternative financial services providers, such as legal advisers, insurance brokers, accountants and management companies should be able to connect his or her client to the right investor or lender. With access to digital platforms, this now becomes possible.

- Increased deal flow and success rate

Investable opportunities are likely to be fewer and far between as we emerge from the economic fallout of the coronavirus outbreak. As such, the differentiator between investors who are able to find and deploy capital will be primarily based on their access to deal flow and conversion rate.

- Intelligent data and aggregation

If you’ve been faced with juggling 2 or 3 deals at the same time, you’ll know that deals are information and data-intensive. Keeping on top of all the moving parts can be a challenge. When we compound this with the lack of access to intelligible data for Africa deals, we can start to see why the average deal cycle in Africa is so long.

By processing deals through platforms, dealmakers are able to generate relevant macro and microdata at the click of a mouse. Not only does this reduce the hours spent by analysts combing through obsolete data, but it also provides real-time data to help managers make better-informed decisions.

Reconfiguring our ways of working

CEOs and investment professionals across the world will be faced with the challenge of how to reposition their firms for the post-corona world. The options we have are to continue business as usual, or reconfigure our companies so we are not left exposed when the next shock comes.

Irrespective of the choice we make, the role of digitisation in the future of all business has been put centre stage. The technology already exists, which means that it’s time for companies to speed up their adoption or risk being left behind.