Most sectors across the continent have had an economic slow down this year, however, the Agriculture sector has been an outlier. Orbitt provides our readers with an analysis of investor appetite (demand) for agriculture investment opportunities across Africa, as well as, supply of investable agriculture opportunities.

Real-time investor data shows a 21% increase in activity in the Agri sector compared to the same time last year. Of the investors who have engaged with the Orbitt platform for deal origination or transaction support services (234 institutions, a group of 138 funds and 96 banks), 52% have agriculture as a key focus investment target for 2020.

110

Institutional Lenders are actively seeking to provide trade finance opportunities in agro-commodities across the continent. 87% of these lenders have East Africa as a region of interest in their mandate, with West Africa being present in 78% of their mandates. Total Asset Under Management (AUM) is in excess of $1.5bn

$280m

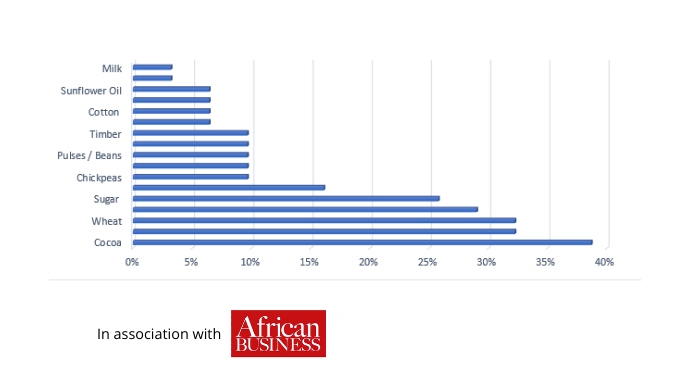

This year, Investors have expressed an interest in c. $280m worth of active Agriculture deals on the Orbitt platform. Of these, 75% are seeking trade finance funding to support their growth plans. These companies are actively trading commodities within their countries of operation, regionally and globally, with a large amount dealing in Cocoa, Cashew, Wheat, Rice and Sugar. (edited)

Cocoa is key

The most actively traded commodity by value is cocoa (West Africa), followed closely by cashew and wheat from East Africa.

Top commodities traded in Africa by Value.

The Orbitt perspective

The growing demand for and supply of capital in the Agriculture sector is a reassuring indicator of the role agriculture can play in the economic growth and food security of most African countries.