Trade finance activity more than doubled from 134 unique lender enquiries in 2019 to 280 unique enquiries in 2020, according to Orbitt data. The average ticket size of these transactions was $8m-$10m. This increase is also reflected in the number of trade finance providers who are actively originating for transactions across the continent. Orbitt recorded 73 active lenders compared to 37 in 2019.

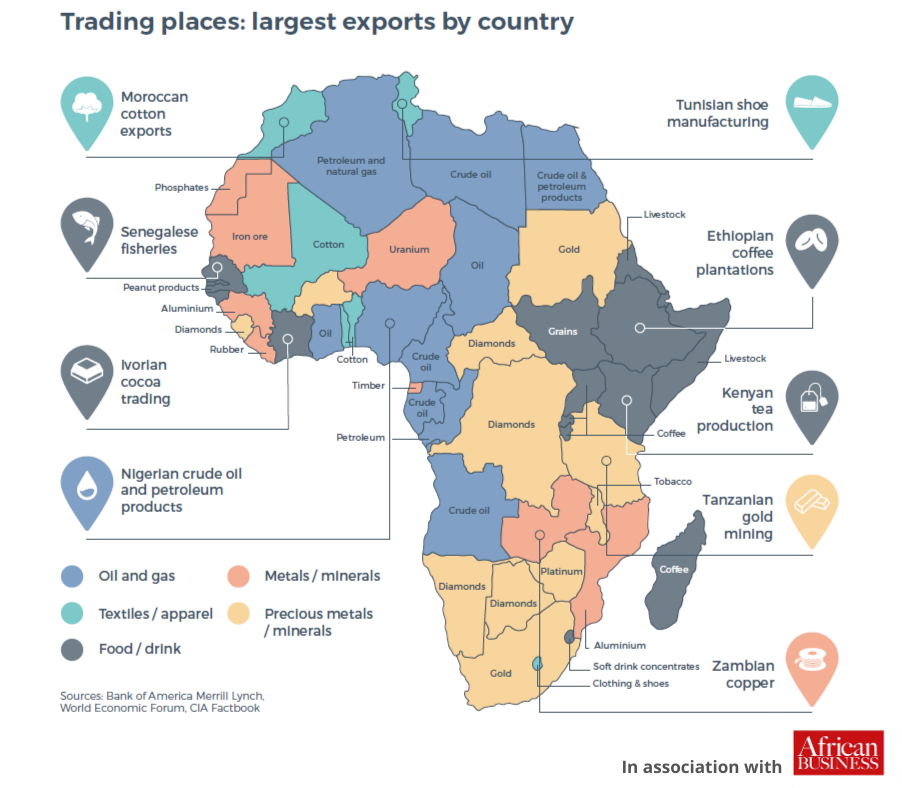

Agriculture has remained a key focus for lenders. It has been the most active sector accounting for over 50% of total trade finance transactions, in 2020. There has been a significant decrease in interest in the oil and gas sector, which saw a decline in total enquiries from 33% in 2019 to 3% in 2020.

This contrasts with the mining and quarrying sector where lenders have been actively originating metal trading transactions an increase from 9% to 32% of total enquiries. As the trade landscape continues to change, there has also been growth in the number of alternative lenders originating trade finance deals. Trade finance has primarily been a bank product, and thus the banks remain the most active in this space with participation increasing from 36% in 2019 to 40% in 2020.