7-minute read (Download PDF)

The wave of digitisation: changing our personal and business lives

Travel in Africa has its challenges, but the emergence of digitally-enabled services is helping to remove some of the obstacles we face when doing business. Imagine a typical business development trip across the continent:

A transaction adviser is on her way from Johannesburg to Nairobi to secure an advisory mandate. It’s likely that she booked her flights on a comparison website like Jumia Travel and chose her hotel with the help of TripAdvisor reviews. As the flight touches down at Jomo Kenyatta Airport, she uses WhatsApp to call the office and confirm her arrival, before logging into Uber to book a ride into town.

A transaction adviser is on her way from Johannesburg to Nairobi to secure an advisory mandate. It’s likely that she booked her flights on a comparison website like Jumia Travel and chose her hotel with the help of TripAdvisor reviews. As the flight touches down at Jomo Kenyatta Airport, she uses WhatsApp to call the office and confirm her arrival, before logging into Uber to book a ride into town.

Despite relying on digital platforms to get from A to B, it’s highly unlikely that the adviser’s team used digital tools to originate the business lead. Her colleagues doubtless even considered how a company in Kenya can procure their advisory services online.

Digitisation is transforming Africa’s economic potential, creating new products, markets and ways of doing business. This transformation, although most visible in consumer-facing businesses, is also taking hold in the financial services sector among intermediary parties.

Forward-thinking organisations are approaching disruptive transformation more strategically to gain competitive advantage. We have seen first-hand how financial services intermediaries who adopt technology solutions as part of operations can improve their productivity and as a consequence increase revenues.

African Financial Services Intermediaries (FSIs): the status quo

The value of 1,022 reported African PE deals between 2013 and 2018 was US$25.7 billion according to the 2018 Annual Private Equity Data Tracker from The African Private Equity and Venture Capital Association (AVCA).

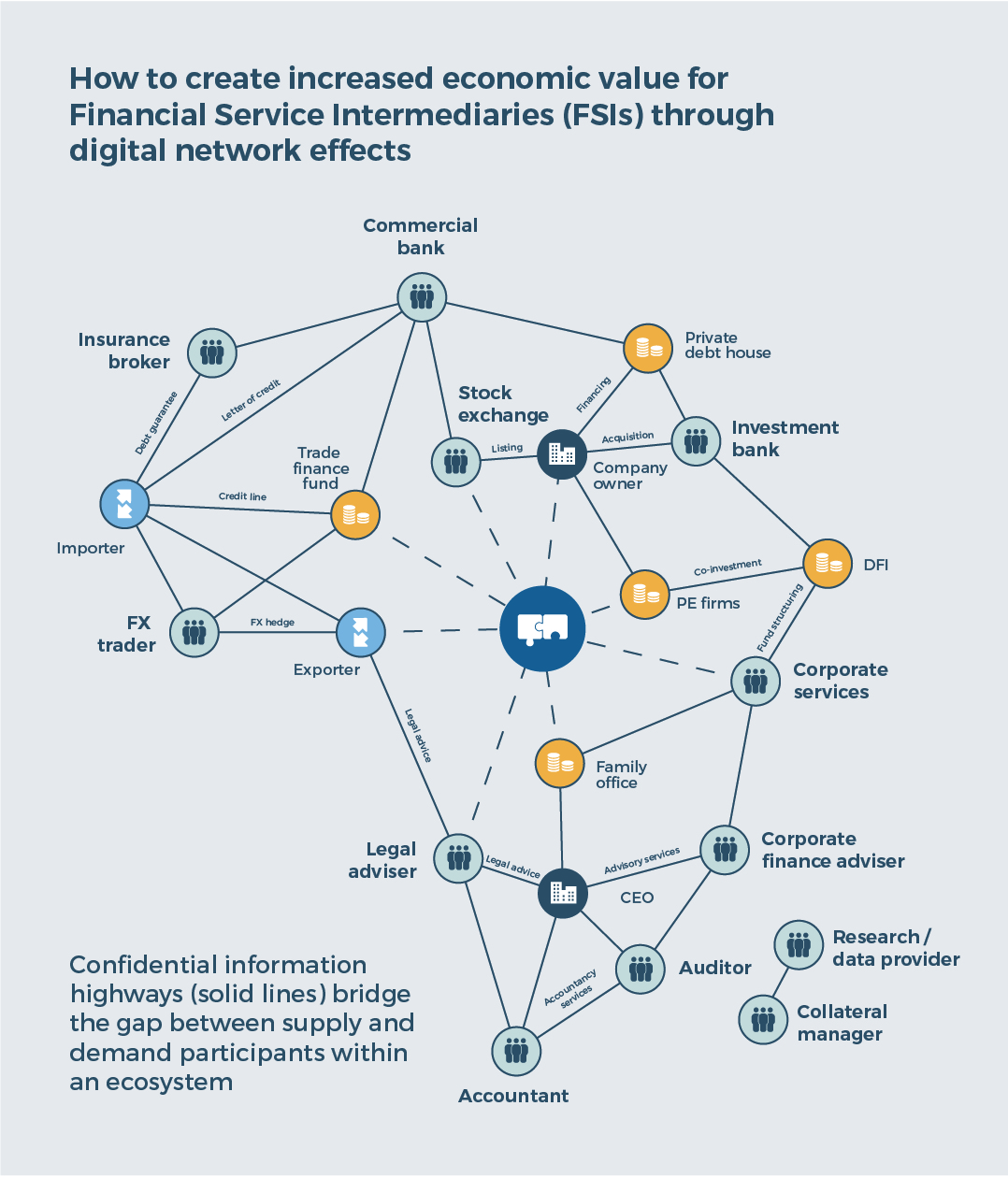

For each of the investments, companies and investors engaged an array of FSIs to provide advice and support through the transaction up to financial close. These FSIs, who are a critical channel for investment capital to African companies, include Lawyers, Accountants, Corporate Finance Advisers, Insurance Brokers and Corporate Service Providers to name a few.

For each of the investments, companies and investors engaged an array of FSIs to provide advice and support through the transaction up to financial close. These FSIs, who are a critical channel for investment capital to African companies, include Lawyers, Accountants, Corporate Finance Advisers, Insurance Brokers and Corporate Service Providers to name a few.

African financial services play a critical role in supporting Africa’s economic growth and contribute to a large proportion of the continent’s GDP. However, research from FSD Africa shows that the contribution of financial technology to the industry stands at just $40 billion. As the other component parts of African economies continue to digitise, so the financial services sector and its professionals will need to think about how then can leverage existing technology solutions. Doing so will better position their services in a rapidly transforming business environment.

Building traditional relationships with digital tools

It’s no secret that Africa is a high-contact society. As a result, investment professionals often see business development as a long and drawn out process that requires physical meetings to ‘build relationships’ with clients. While we couldn’t agree more with this, we also believe that FSIs could increase productivity and revenue without increasing the marginal cost of acquiring a new client or mandate.

By rethinking some of the assumptions about how business is done in Africa, or better still, by highlighting some of the challenges inherent in traditional methods, we can think about business development from multiple angles and in unconventional ways.

To fully exploit the resulting opportunities requires a reconsideration of how lead generation can take place digitally. Most importantly, the output has to enhance client relationships to foster brand awareness and trust within nuanced and often sensitive industries and markets.

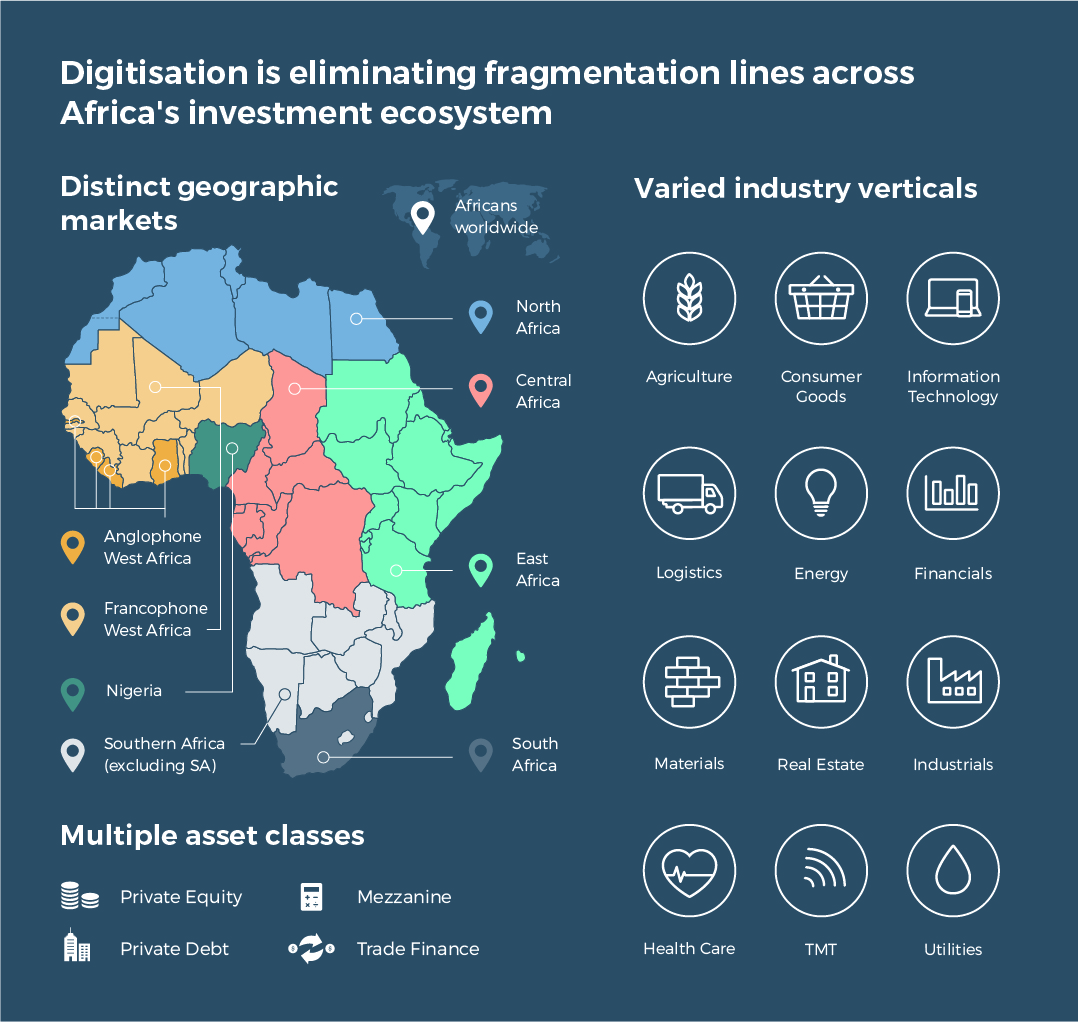

Africa’s fragmented investment ecosystem: connecting the dots

According to numbers derived from LinkedIn, there are over 800,000 professionals who work in the financial service sector with an interest in Africa. From our observations, many of these FSIs operate in silos. The advantages of holding deeper relationships with clients in one domain, reduces the overall visibility of other opportunities which may help to grow the business in new markets, sectors or asset classes.

Asset class

Many FSIs specialise in providing services across one of the primary asset classes active on the continent. This could be Private Equity, Private Debt or Trade Finance and will often mean working with a handful of PE and debt funds or Development Finance Institutions (DFIs). Alternatively, an FSI may work closely with the local and international banks.

The chances of meeting a corporate finance adviser who has completed transactions across multiple asset classes on the continent is rather slim. More often than not an adviser will have worked on Private Equity or Bank debt deals but not yet explored Trade Finance opportunities.

Geography

We often hear conversations at investment conferences that identify the geographic fragmentation of Africa’s financial markets as a constraint to growth. It is not uncommon for professionals to take this at face value as one of the challenges of doing business in Africa.

In the age of digitisation, we see this as a dated view. Given the ease of having WhatsApp conversations with friends and family scattered all over the world, why should we have a mental barrier about being able to do business across the continent using digital communication?

Take for example a corporate services provider based in Mauritius who wants to grow his business in West Africa. Should he shy away from Ghana because he has limited market knowledge or contacts in the region? Since his services are likely to fit the requirements for many businesses in the country this shouldn’t be the case.

If he can originate digital leads, screen these targeted opportunities and have initial communication with prospective clients in advance, when he eventually flies to Accra, he can focus on building relationships and securing the mandate.

Services

We’ve all asked our friends and contacts for an introduction to a reliable FSI, be it a lawyer, corporate finance adviser or insurance broker.

Is this the most efficient way to find a service provider in a particular country of sector? We should be able to discover and consume these services in the same digital way that we’ve come to expect when finding the Uber driver to take us to our next meeting in Lagos. By having access to information, reviews and track records of FSIs we can increase the likelihood of finding a long-term partner.

Piecing together the information asymmetry

Financial services are complex and diverse. The challenge is therefore to efficiently capture the relevant information – while catering for the nuances of African FSIs – and present this digitally. With new advances in technology and management thinking we believe an ecosystem solution can address this challenge.

Successful ecosystems work when each participant provides the best information about their services (supply) and companies needing these services provide the best information about their requirements (demand). Bringing these two parties together removes the barrier of gathering fragmented information about service providers and ensures that each party speaks with the right counter-party with the singular objective of transacting.

Judging the success and quality of services is of course subjective. Furthermore, real-world interaction sits at the heart of service delivery. This makes it hard to disaggregate parts of a procurement process that might be carried out online. What is clear, however, is that smaller service providers have historically lacked the tools or time to come online as they expend considerable energy trying to convert leads across fragmented markets, asset classes and industries.

Separating the physical and the digital

A closer look at the business development funnel of an Africa-focused FSI reveals how certain aspects of the process can be better optimised using technology (origination) and how others must remain offline for the time being (transaction and completion).

These fragmentations spotlight an opportunity for investment professionals. As business increasingly takes place online and analytics tools become more powerful, FSIs can gain a clear edge over competitors by using digital platforms to better identify and convert targeted leads.

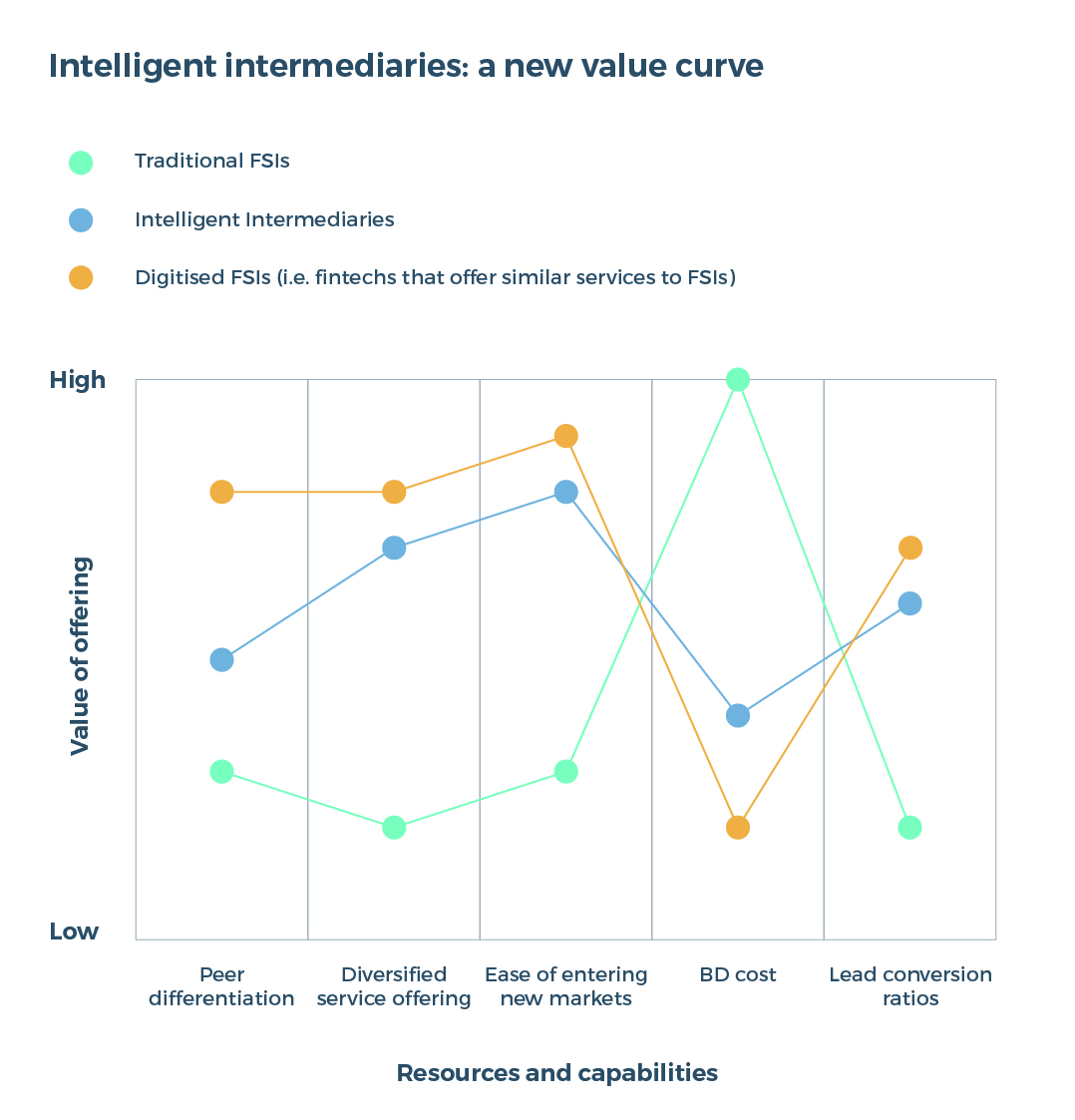

Digital differentiation: drawing a new value curve

Corporate finance advisers and investment banks on the continent are redefining their value proposition by leveraging technology platforms.

The same principles apply to the entire FSI ecosystem who have to opportunity to digitise individual aspects of their service offerings. Africa-focused service providers can reconfigure their business models to spend more time and resources on high-value aspects, such as putting together IMs or placing insurance coverage. Put simply, smart lead origination reduces the time spent chasing leads and increases productivity.

Redefining competitive boundaries with digital differentiation

For FSIs who offer ubiquitous services, the perception might be that there is little room for differentiation other than the pricing point.. But a small 5-person team shouldn’t need to target the Dangote Group for their services, nor should a 500-person FSI be the right adviser for an SME that requires a bespoke and personal service.

With smart and segmented targeting, best achieved with digital tools, FSIs are able to grow their pipeline with businesses that they are best equipped to service. As a result, FSIs can deliver higher client satisfaction and retention.

Not only does a digital ecosystem replace opaque business referrals, but it also creates new opportunities on an information-basis as opposed to a personal whim. The more professionals within an ecosystem, the more powerful these information highways become. In turn, participants create and share higher volumes of relevant data and knowledge.

Offering deeper and broader services to existing clients

When clients ask their existing FSIs to recommend additional services such as corporate finance advisers or legal counsel, the natural first step would be to reach out to your local network.

It can be a challenging task to refer professionals who operate outside of your speciality or sector especially when the client has cross-border requirements.

Digital networks help FSIs to deliver additional value to their clients without having to invest in or hire expensive staff who have international networks and capabilities. By using digital tools to build a balanced portfolio of clients, service providers can connect companies to each other, therefore providing a further layer of support.

Entering new markets at a fraction of traditional cost

Market entry is time-consuming, costly and often stressful. By using digital tools to contact the right opportunities and real decision makers in advance of trips, the travel becomes more productive and less time is wasted picking up business cards from people outside of your core focus.

Digitising the business development process means that FSIs can generate actionable insights across multiple variables such as company size, specific type of service required, region, country and industry. This is a compelling tactic to complement in-market trips and secure more business.

Lead generation vs conversion rates

Business development is the first stage of the FSI value chain. It is often the most important stage for generating a competitive advantage and still very much a human endeavour.

But by targeting a specific segment of a larger universe of companies, FSIs are able to improve conversion ratios and ultimately increase the bottom line.

Using platforms as a service: leveraging technology

After many conversations with African service providers and institutional investors, it quickly becomes clear that the use of technology has not been central to business strategy across the continent. This applies for all service providers from the small 2-man shops up to the 500+ employee organisations.

Digitisation of trust

Confidentiality is a key element in the financial services ecosystem. Sensitive transactions demand skilled compliance teams, multiple NDAs, a stringent KYC process and regulatory requirements for certifications.

Digital platforms deliver a cost-effective solution in building a community of trust. This requires the platform managers to approve members and improve the service experience. Rather than letting customers first discover the end providers and second build trust, digital platforms take on the work of creating trust from the outset so that all parties exchange maximum value during each interaction.

Reducing barriers

Before the emergence of the internet, the regulation of services was critical to signify a certain level of skill or knowledge required to perform a job.

The role of software services and technology platforms is to expose more information about providers and establish trust through reviews, guarantees, platform requirements, and other mechanisms. This mitigates the need for rigorous licensing and removes the entry-barriers for smaller service providers who are looking to access a larger market, thus expanding and augmenting the supply pool.

The future belongs to intelligent intermediaries

The past decade has seen the boom of digitised services across Africa. From transport to payments, communication to hospitality, consumers now expect digital marketplaces to provide the services that they require.

The past decade has seen the boom of digitised services across Africa. From transport to payments, communication to hospitality, consumers now expect digital marketplaces to provide the services that they require.

The next few years will see technology fill this void for many more industries that are yet to reap the benefits of digital connectivity and online tools. These services are often filled with operational and regulatory hurdles, which presents a massive opportunity to positively impact the quality and convenience of consumers’ everyday lives.

Within this context, Africa-focused financial services providers have the opportunity to leverage digitisation to grow their businesses and deliver their services intelligently.

To find our more about how your firm can be a part of the Orbitt platform and generate new leads for your services: