This brief was developed by Sofala Partners, an Africa-focused risk and advisory firm

Is currency risk the number one challenge for African investors?

I. Depreciation and volatility

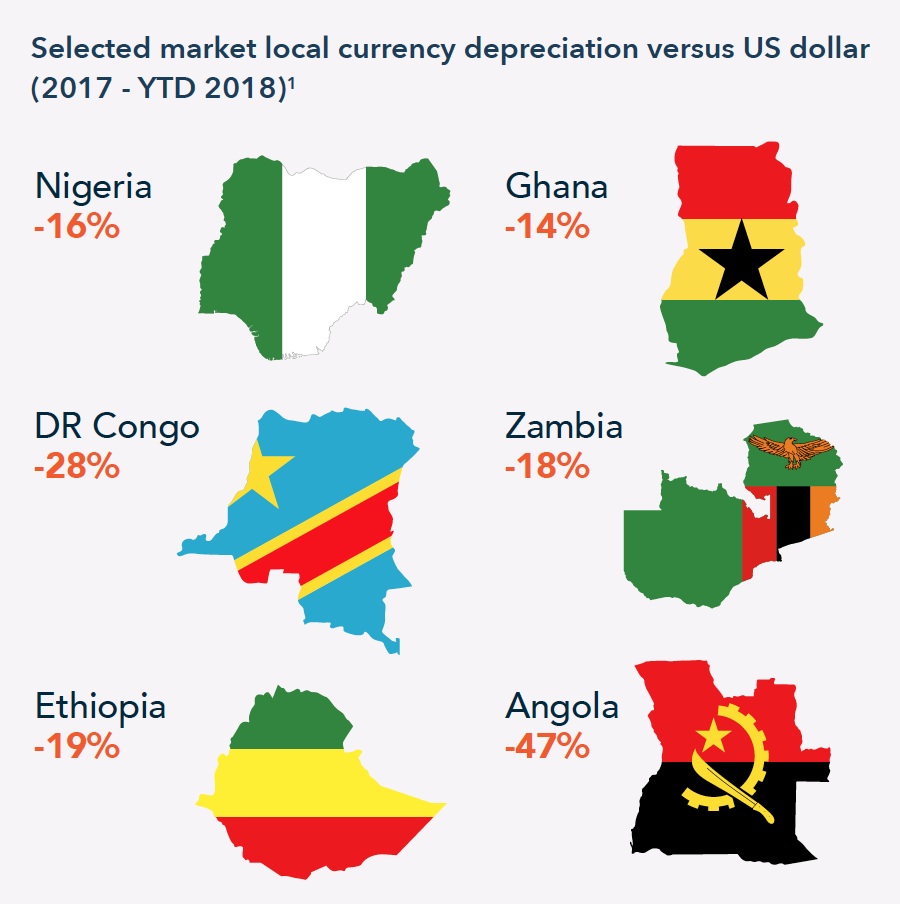

Foreign exchange is arguably the most important part of the risk equation for any business operating in Africa, as demonstrated by the series of material local currency depreciations in major regional economies over the past two years.

Several factors can prompt this kind of sharp depreciation, but two stand out from the rest. The first is commodity price volatility: economies with high dependence on a single commodity for export earnings are vulnerable to currency swings that track prices for their primary export. Following the oil price crash from 2014-16, Nigeria’s naira suffered a brutal correction, losing over 45% of its value from June 2016 to August 2017. Similarly, the Angolan kwanza lost more than 46% in 2018 after a dollar peg implemented in 2016 was abolished in January. Indeed, in economies which are heavily dependent on commodity exports, there is a structural imbalance between foreign exchange demand and supply which leads to increasing volatility linked to commodity market fluctuations.

The second factor is sovereign debt. Where government borrowings become unsustainable, the currency will face pressure. This was the primary issue in Mozambique when the metical fell approximately 45% from October 2015 to October 2016 after debt-to-GDP climbed over 100%, culminating in an eventual default in January 2017 and pariah status in global debt markets.

II. Exchange controls and lack of liquidity

A further concern for investors is that many governments in Africa place restrictions on foreign exchange movements – for example, capping company flows out of the country at the level of the company’s declared annual net profit. Withholding taxes – typically in the 10% to 20% range – are also applicable across many markets, adding a cost to cross-border movements of hard currency.

Beyond official exchange controls, liquidity shortages in foreign exchange markets often create parallel markets. This disparity between central bank rates and “real” rates available in the market widens in more illiquid markets, particularly when the local currency is weakening fast.

In countries such as Zimbabwe or Ethiopia, dollars are both scarce in the market and difficult to repatriate even when they are available. Outside of the more developed South Africa market, efforts to improve liquidity by creating foreign exchange platforms have struggled to get off the ground. For example, the ambitious Global Board of Trade (GBOT) project, launched in 2010, officially ceased operating at the beginning of 2018, citing low trading volumes.

Linked to this lack of liquidity is a shortage of appropriate products in local currency markets to meet investor needs. For example, local banks are generally unable to provide local currency bonds with sufficiently long tenors to fund major projects. This is a particular issue for infrastructure projects where investors are often obliged to borrow in hard currency for projects where outgoings are in local currency.

*From 1 January 2017 to 30 November 2018. Source: xe.com

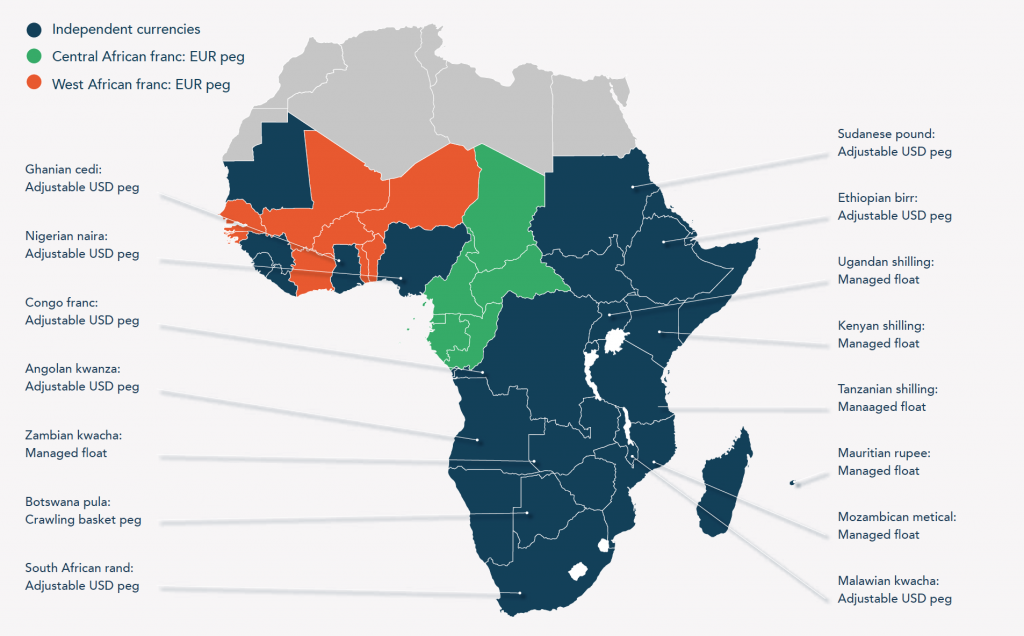

A diverse currency landscape

In this briefing, we try to make sense of a complex continental picture, providing a guide both for assessing and mitigating currency risk in a fast-evolving monetary environment. To begin to gauge their risk exposure, investors first need to assess the region’s diverse currency environment. Broadly, currencies in sub-Saharan Africa can be segmented into four categories:

- Pegged (e.g. Euro pegged West African franc and Central African franc)

- Free-floating (e.g. South Africa rand, Kenya shilling)

- Adjustable USD pegs (e.g. Ethiopia (crawling USD peg) or Sudan (central bank fixed USD peg))

- Quasi pegged (trade basket; e.g. Botswana pula)

The shape of currency depreciation is dependent on the level of central bank intervention and willingness to use foreign exchange reserves to maintain local currency rates against the dollar. For free floating currencies such as the South African rand, foreign exchange rates can be volatile and move sharply on the back of specific news events. Elsewhere, most unpegged African currencies are subject to a level of central bank support. However, this means investors need to contend with “jump” risk, where a central bank may decide (either for strategic reasons or due to practical imperatives such as a lack of reserves) that a step-change local currency devaluation will take place. This was the case in Ethiopia in October 2017 when the birr was devalued by 15% in a bid to increase exports.

On the flip side, central bank policy can help to improve the foreign exchange environment for investors and businesses. For example, in Nigeria since the naira crash, the central bank (CBN) has made notable strides in developing local hedging tools. There is now a naira-settled OTC futures market, which is effectively a non-deliverable forward supported by the CBN. In this market, the underlying exchange rate is the flexible Investors & Exporters (I&E) window rate, which helps to minimise exchange rate risk (though not liquidity). Investors, banks and importers all have access to the market which can be used for hedging of foreign currency loans, capital imports, dividend repatriations, airline remittances, letters of credit and provisioning for foreign currency loans. The size of the hedge market has gone from zero in April 2017 to $4.4 billion by 2018, showing its relative success.

A playbook for gauging currency risk

The corporate perspective

Businesses need to ensure they are resilient to exchange rate risk, avoiding any exposures that could wipe out their margins and render them uncompetitive. There are three ways to think about this: margin risk, earnings conversion risk and debt servicing risk. Let’s take each in turn:

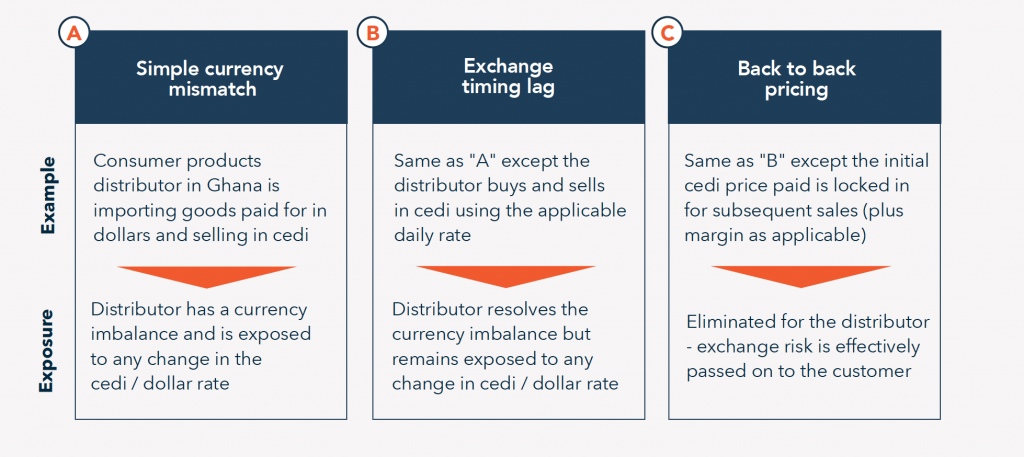

1.Margin risk

Margin risk is where there is a foreign exchange mismatch between costs and liabilities versus revenues and assets. This can take several forms:

While these three scenarios are a simplification, clearly scenario A is generally to be avoided (unless there is a deliberate currency play as part of the business model) whilst scenario C is the most desirable. However, many businesses find themselves in scenario B as the nature of their supply chain does not enable true back to back pricing. For example, pricing review cycles might be quarterly whilst orders are placed on an as-needed basis. Where manufacturing is involved, the picture becomes murkier still as there may be a whole range of raw material costs in a variety of currencies, coupled with a significant local currency manpower cost. Hedging solutions might be required for these businesses to avoid price fluctuations linked to exchange rates. For export industries such as mining or tourism, the exposure is inverted with revenues generated in hard currency and a cost base predominantly in local currency. These industries will typically accept the foreign exchange risk (which is normally an upside) as part of their operating model.

2.Earnings risk

Earnings risk is the risk to the bottom line when profits are converted from local currency to the reporting currency (e.g. US dollar). Whilst margin risk should be identified and eliminated wherever possible, earnings risk should be managed through best practices rather than attempting to eliminate it altogether. For example, where hard currency is required (for dividend payments, servicing holding-level debts, and so on), distributable reserves should be upstreamed annually directly after statutory accounts filing. Financing arrangements at the holding level can provide an effective means to hedge local exposure: for example, if 75% of earnings are typically generated in euro pegged countries (e.g. CFA zones), then holding debt should similarly be 75% euro-denominated to create a “natural hedge” at the corporate level.

3.Debt servicing risk

Beyond foreign exchange conversion risk, entities taking on debt outside of their operating market expose themselves to three additional risks:

Convertibility risk: the borrower may be unable to meet payment obligations made in hard currency due to restrictions on the sale or purchase of foreign currency (for example, if there’s a need to service dollar debt and dollars become unavailable or constrained in the market)

Transfer risk: the borrower may be unable to meet payment obligations if the government imposes restrictions on the movement of capital outside of the country (or the borrower may face unforeseen increases in cost if – for example – withholding taxes are introduced)

Interest rate risk: the borrower may face changes in the cost of borrowing due to the interest rate structure in their financing agreement. For instance, a company may take out a local currency loan with the rate indexed to LIBOR – and any increase in LIBOR would increase interest expenses.

The fund manager perspective

In terms of mitigations, the first two risks can be considered as insurable events and can be covered through political risk insurance policies. Interest rate risk can be hedged but it is more common for borrowers to assume this as part of their group capital structuring.

Private equity and venture capital investors often bear significant currency risk. With multi-year investment horizons and illiquid assets, finding a means to hedge their exposures is tricky. Whilst “business as usual” depreciation assumptions are typically priced in, sudden currency devaluations of the kind seen in Nigeria in 2016-17 can decimate returns from otherwise profitable investments. Consequently, it’s not surprising to see that fund managers (GPs) and limited partners (LPs) view currency as the most important macro risk they face. The major challenge for private equity is that existing products are not well matched to their needs. Traditional hedging instruments available through banks are too expensive, too specific (in amount and tenor) or too short term. The traditional private equity model – a 7 to 10 year closed-end fund taking minority stakes in brownfield investment opportunities – is perhaps too rigid for Africa’s dynamic macro environment. One option is to switch to an open-ended holding company or permanent capital vehicle structure, whereby investors have no obligation to sell or cash out at a fixed point in time. Dividend streams can compensate for longer-term holdings and there are no restrictions over the timing and structure of investment exits. The HoldCo management team can also spread risk by building a diverse portfolio of operating companies – for instance, offsetting profits in one OpCo with forex-induced losses in another to optimise tax exposure. A growing number of investors are choosing this model, which combines flexibility with long-term investment horizons. Examples include Cranemere Africa, Maris Africa and AgDevCo.

The project developer perspective

For project developers committing capital to infrastructure projects, there is typically an inherent imbalance between a significant local currency cost base (labour, construction materials, etc) and a hard currency long term financing facility (e.g. 20-year dollar-denominated bond). Lacking liquidity, local banks are generally unable to provide long term financing facilities in local currency, obliging investors to bear the currency risk themselves. Such exposures deter capital: consequently, projects that offer both high development impact and attractive returns get overlooked.

Faced with a cocktail of volatile currencies, illiquid exchange markets and restrictions on movements of capital, both corporations and fund/project managers need to get creative and explore the full spectrum of options for managing currency risk. Hedging products offered through the banks are often expensive and ill-suited, especially for investors with longer timeframes. However, new and more attractive products are becoming available to manage exposures. In the next section, we run through the menu of options.

Looking beyond traditional finance

Development Finance Institutions (DFIs) are acting to address the gap in long-term local currency financing. Whilst institutions such as the International Finance Corporation (IFC) began addressing this in the 1990s by offering local currency loans and hedging solutions, in the last decade a number of dedicated entities have been established to provide facilities that meet the needs of a range of long term project investors, as well as other players such as microfinance organisations.

Development Finance Institutions (DFIs) are acting to address the gap in long-term local currency financing. Whilst institutions such as the International Finance Corporation (IFC) began addressing this in the 1990s by offering local currency loans and hedging solutions, in the last decade a number of dedicated entities have been established to provide facilities that meet the needs of a range of long term project investors, as well as other players such as microfinance organisations.

Hedging for development actors

Founded in 2007, The Currency Exchange Fund (TCX) was one of the first institutions dedicated to providing hedging solutions to support development capital. TCX provides a range of hedging services across emerging markets (>50 currencies hedged to date), with >$4 billion in DFI loans converted into local currencies. This enables project developers to eliminate currency mismatches between their facilities and their cost base for project delivery.

Similarly, MFX was established in 2009 to address the needs of the smaller-scale actors (primarily microfinance) and to date has hedged >$1.8 billion in 50 currencies, with quantums varying from $50,000 right up to $50 million. The MFX product offering is tailored to suit microfinance and impact investors – for example, whilst bank financing typically requires collateral of 25% or more, MFX will lend with little or no collateral.

Guarantors

Complementing these providers of dedicated hedging products are guarantors such as GuarantCo. These organisations enable long term project finance by bridging the gap between what the local currency market is able to offer and what the project actually needs. To take an example, when an affordable housing project in Nigeria was looking for funding, GuarantCo guaranteed a 7.5 billion long term naira-denominated bond providing high investment grade local currency debt, with an additional unguaranteed 2.3 billion naira tranche in which the African Local Currency Bond Fund was the main participant. By guaranteeing local currency debt, GuarantCo enables financially robust local currency projects and companies to establish stable local financing and brings new long-term local currency bonds to the market for investors. Further, GuarantCo is seeking to broaden the investor market for local currency debt, creating a partnership with the London Stock Exchange that will allow local currency debt issuers access to global markets. DFI support on local currency financing puts new options on the table for impact investors and infrastructure projects. It also has wider benefits for the business community as it can mark an important first step – or ‘demonstration effect’ – towards more liquid local currency lending in markets where banking products are not available, unaffordable or unworkable (for example due to prohibitively high collateral requirements).

Alternative hedging approaches

Besides hedging products, an array of innovative solutions can be applied to achieve at least a partial mitigation of currency risk exposure – often at a fraction of the cost of true hedging. These should be tailored according to the specifics of the investment or business to be financed; however, the following three examples shed light on what’s possible:

Alternative hedge example 1: Blended currency debt basket

Whilst hard currency debt is usually denominated in a single currency (e.g. US dollar), banks can provide facilities with a blended basket of currencies. This has two main advantages: firstly, it protects against foreign currency volatility by linking to multiple currencies; and secondly, it reduces reliance on US dollars, thereby providing a mitigation on convertibility risk. This is particularly helpful in East and Southern Africa where alternative hard currencies such as euro, yen, rand and renminbi often remain available even in cases where dollar availability dries up.

Alternative hedge example 2: Proxy hedging

Where financial hedging products are unavailable or inappropriate, companies may find proxy assets to invest in as a hedge against currency volatility. For example, land purchases might provide a company with a means to store value and shelter from currency volatility (land values can be more stable in hard currency terms). However, choosing the right asset to use is critical – as well as being a stable value store it must also have appropriate liquidity to avoid trapping value beyond the envisaged timeframe.

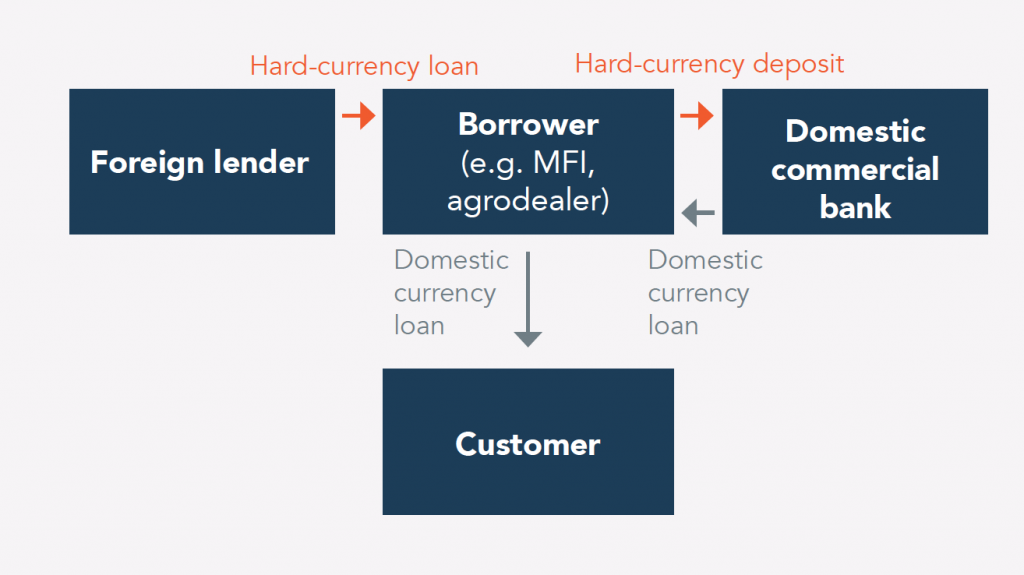

Alternative hedge example 3: Back to back loan

An entity takes out a hard currency loan with an international lender which it then deposits in an interest-bearing account and uses the dollar amount as collateral for a local currency loan.

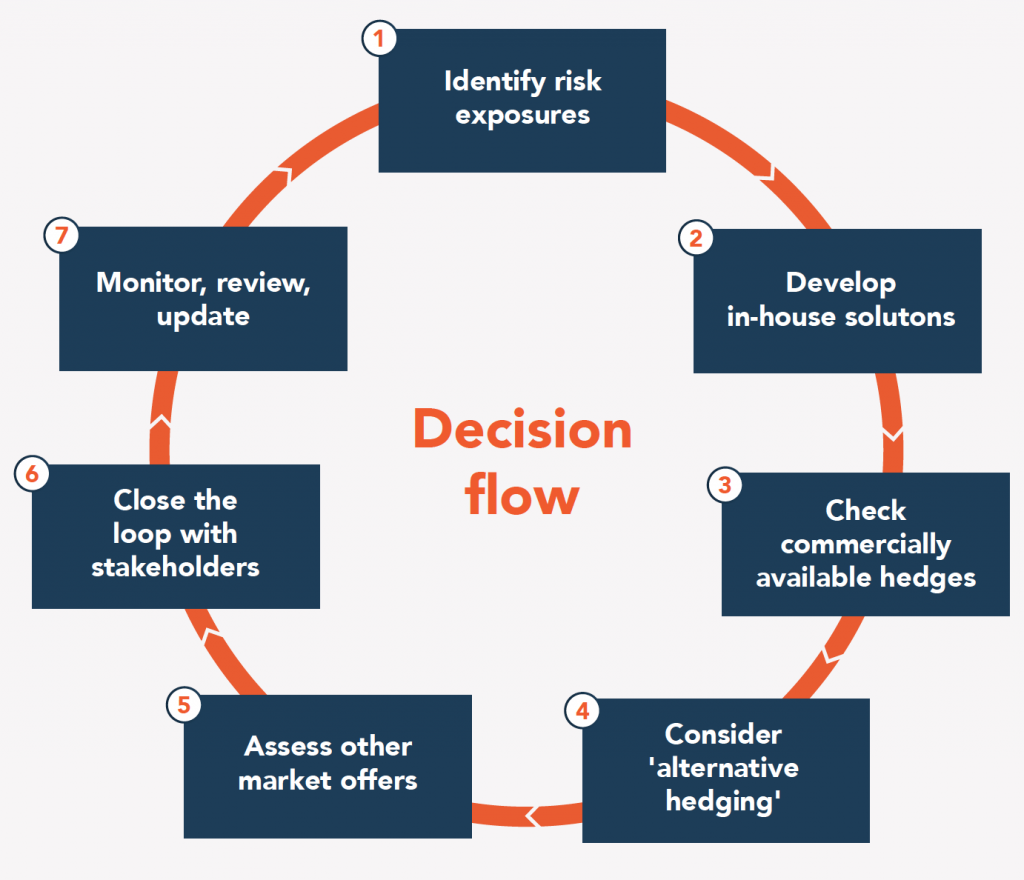

A ‘toolkit’ for managing forex risk

As hedging facilities across much of the continent are either not available or prohibitively expensive, there is no “silver bullet” available to manage forex risk. However, with a structured approach, investors can effectively evaluate and manage their currency exposure. We’ve sketched a framework for action below:

1) Identify risk exposure

- Evaluate currency exposures created both through business operations and financing facilities

- Conduct scenario planning to simulate the impact of currency depreciations

2) Develop in-house solutions

Operations

- Optimise to minimise structural currency exposures

- Example: ensure input costs are local currency (LC) if sale price is in LC

Cash Management

- Integrated management of bank accounts

- Use single currency areas for free movement of funds (eg. CFA zones)

- Protect earnings by planning cash upstream (e.g. prompt dividend payments)

3) Check commercially available hedges

Financial markets

- Are hedging products available (locally or on international exchanges) and at prices that make sense

- Example: Is LC financing cheaper than hard currency financing after accounting for depreciation

4) Consider ‘alternative hedging’

Operations level

- What alternative hedges could be put in place to mitigate currency risk exposure?

- Are there assets that could act as an effective proxy hedge against devaluation?

Portfolio level

- Would it be appropriate to borrow in USD or EUR to match underlying currency exposures in operating countries within the portfolio (thereby creating an internal hedge)?

5) Assess other market offers

Alternative financing providers

- Are there appropriate alternative products (e.g. LC bonds, hedges) available outside of traditional banking

- How do these other offers (e.g. through DFIs) compare to commercially available products?

Insurance

- Do you need to insure against other currency-related risks (e.g. relating to blocks on currency convertibility or capital transfer?

6) Close the loop with stakeholders

- Once options have been evaluated, it is critical that the approach for managing currency risk is communicated to the stakeholders.

- It is likely that the current risk is only mitigated rather than eliminated altogether – stakeholders need to understand this to avoid surprises.

7) Monitor, review, update

- Monitor central bank policy, plus any key factors driving foreign exchange flows (i.e. commodity prices and/or sovereign debt levels) and plan regular review cycles to update your currency management approach

Contact: Anna Riley, Managing Partner, Sofala Partners

Sofala Partners has several decades of combined experience advising the most influential companies and organisations operating in Africa. With offices in London and Nairobi, the team works at the heart of information flows, drawing on an in-market network that covers 35+ countries in the sub-Saharan region.