The need to mitigate supply chain disruption risks: The case for Trade Disruption Insurance

There has been a large influx of speciality trade finance funds over recent years in an effort to mitigate the tremendous trade finance deficits across emerging markets and in particular Africa. This widening gap, in part caused by the global banking industry on the back of Basel III & IV regulations, has enabled new trade finance funds to fulfil an essential role in financing the continent’s energy, infrastructure, agricultural and sustainable development requirements. With greater awareness about how to manage risks and generate steady returns, we should see many more institutional investors making considerable commitments in the near future.

For most investors, trade and project finance are unknown. In other words, these asset classes do not correlate to traditional investments in listed exchange securities or fixed income such as treasury securities., Although, statistically, trade finance has a drastically lower default rate than other mainstream investment vehicles, trade and project finance takes investment analysts and fund managers – used to studying corporate balance sheets, P&Ls and Price-Earnings forecasts – out of their knowledge and comfort zone,

There are a number of new entrants to the trade finance fund community whose General Partners (GPs) are former commodity-focused bankers. For these funds, the biggest task in securing institutional investor appetite is to educate their potential Limited Partners (LPs) about the nuances of commodity trade finance risk. This essentially comes down to managing Supply Chain Risk, i.e. the risks of getting goods and services from point A to point B.

The key questions when assessing risks

For both the investor and the newcomer to trade finance, assessing supply chain risks must also include an assessment of supplier and obligor (buyer) risks; delivery and transport risks; country and sovereign risks; counterparty & default risks; and production risks, to name a few. In short, fund managers have a fiduciary responsibility to their investor clients to guide them with a robust risk management process.

It is inevitable that problems can occur in the supply chain. To take a more specific example, how might a fund manager evaluate the value of investing in a pool of short-term receivables for a supplier of petrochemicals being sold to a wide base of buyers throughout sub-Saharan Africa and the MENA region? A coherent risk management and insurance plan would be required, based on a number of factors. Whether the investor is investing on a direct basis or on an indirect / bank-intermediated basis may also dictate the type of risk program that is developed. The key questions to ask in an investment scenario such as this are:

- What is the exporter’s experience in selling to these buyers?

- If prior experience, have there been any contractual or payment defaults?

- Did the exporter have credit/political risk insurance from which to submit a claim?

- If there was a deviation of delivery to an alternative discharge port, what were the financial implications (loss of revenue, extra costs, penalties)?

- What was the law of contract for these transactions and would it enable the exporter to enforce their rights to payment in the event of obligor default?

- Did the contract contain a Retention of Title clause?

- What happens if the cargo is lost or damaged?

- What are the contractual stipulations between the investor and the exporter and/or bank that is buying the exporter’s receivables?

A growing global understanding

Over the last several years, the issue of supply chain risk management has assumed a more prominent place for international traders, contractors and banks, as geopolitical and counterparty risks have become a key driver.

We all read the headlines every day in the global press about political violence, terrorism, sanctions, government corruption, and the list goes on. Piracy attacks in the Gulf of Guinea, the Iranian threat to close the Strait of Hormuz, as well as the post-election political violence in Côte d’Ivoire in 2011 that temporarily halted the export of cocoa beans to the world market, all have a tremendous financial cost if companies are caught off guard without having contingency plans in place.

In a World Economic Forum study entitled, ‘New Models for Addressing Supply Chain and Transport Risks’, the conclusion was that “supply chain and transport disruption were no longer just an issue for a company’s operational risk management team, but one where a top-down corporate review was essential from a policy compliance perspective.”

The study found that 90% of those companies interviewed, revealed that supply chain and transport risk management had been given greater priority in their respective organisations. Furthermore, the study also revealed that nearly half of the respondents interviewed, cited conflict and geopolitical risks as key growing concerns.

What is fuelling this recent concern amongst corporates?

Given today’s uncertain and volatile geopolitical and economic environment, particularly with a new COVID-19 backdrop, the proactive use of political risk insurance is once again taking centre stage to combat risks to end-to-end supply and transport chains. Banks, corporates and investors are looking at their cross-border country and counterparty risk exposures and trying to make a determination as to what risks they feel comfortable in retaining versus those exposures in the aggregate, that if left unmanaged, could have a severe impact on their earnings. A MIGA (Multilateral Investment Guarantee Agency)/World Bank study found that in 2010, 14% of all foreign direct investment flows were covered by political risk insurance, the highest level since the 1990s.

Geopolitical and counterparty risk concerns in the global supply (physical and financial) and transport chains has necessitated that companies consider alternative risk and insurance solutions that extend beyond the traditional Property & Casualty (P&C) programs. Because political and counterparty risk perils are excluded from P&C programs, the key is to structure a comprehensive risk management program that will fill in the gaps in coverage. Banks are also fuelling this resurgence in political risk management, as political risk insurance in its many forms, including Trade Disruption Insurance (TDI), is now often a requirement and condition for financing trade and projects, particularly in higher-risk territories.

For commodity traders, charterers, vessel owners, operators, oilfield suppliers and service exporters, there is always the risk that a cargo (and the chartered vessel) will become damaged at any time along the transport chain, and the consequent loss of revenue that would result. A company’s Contingent Business Interruption Insurance program would respond to these risks and covers them accordingly.

However, if there is the absence of any physical damage or loss event, will the company be covered? The answer to this is no.

The advantages of Trade Disruption Insurance (TDI)

TDI is a package program that comprises physical asset, transit and specified commercial and political risk perils that protect the policyholder against the loss of earnings owing from a delay or force majeure event.

Why is TDI considered “gap” insurance?

While TDI uses the same concepts as traditional business interruption insurance, TDI broadens the scope of coverage and is not reliant upon a physical damage event in order to be indemnified for a loss.

- Supply chain disruptions represent a significant threat and cost to a company’s balance sheet and bottom line.

- For the global oil and shipping industries, there is the on-going vulnerability of your company’s supply chain to geopolitical, social and security threats and disruptions from terrorism, political violence and various commercial risks.

- There are often unbudgeted extra costs and expenses incurred in responding to a disruptive event that results in the contractual non-performance by a key supplier or service provider, and the subsequent non-delivery of these essential goods and services.

- Designed to safeguard a company’s entire trade flows from manufacturing through to final sale and delivery.

- It is an essential Trade Risk Management tool that fills in the gap of coverage where traditional business interruption insurance would otherwise exclude such perils.

- Secures income that is supply chain dependent

- Lowers the cost of capital by protecting incomes streams

- Because more and more companies operating internationally are at increased risk to interruptions in their supply chains that call for a package approach to protecting both assets and earnings.

TDI, therefore, responds by protecting companies from the unforeseen additional costs and expenses and loss of profit caused by disruptions, even if no physical loss occurs.

What are some of the insurable perils that TDI protects against?

- Failure of a supplier to deliver goods on time and the consequential penalties incurred.

- Insolvency or bankruptcy of a supplier or buyer.

- Closure of ports, railways or airports and the blockage of waterways.

- War, civil war, political violence, terrorism, revolution, riots and strikes.

- Confiscation, expropriation and nationalization of supplier’s and buyer’s business.

- The imposition of trade restrictions and embargoes.

- Disruption of transport logistics.

- Re-routing and/or diversion/deviation of shipment and deliveries necessary to fulfil a contract.

- Damage to handling equipment in port, rail yard or airport.

- Weather-related perils.

Trade Disruption Insurance is a powerful tool in which to more aggressively and proactively manage and mitigate many of the non-physical supply chain and transport-related risks.

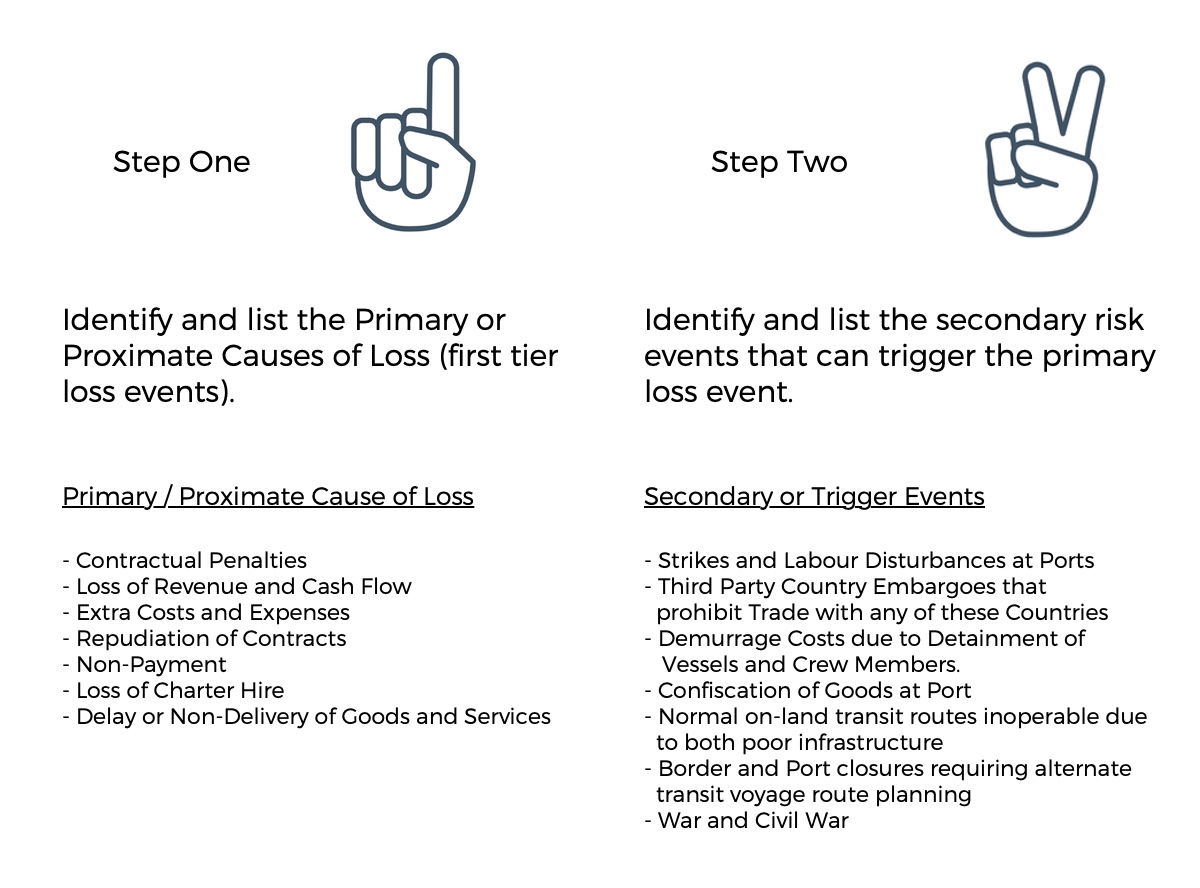

As with any risk assessment and risk management exercise, in order to better identify, understand, quantify and mitigate a potential loss exposure, by developing a two-tiered matrix of risk variables, the Risk or Finance Manager can then manipulate this data to develop their own scenario planning/risk management guidelines. Using the Gulf of Guinea news article as the basis for our analysis, we can develop this matrix as follows:

Without a proper risk management plan in place (whether risk retained, self-insured or insurance risk transferred), the affected party would incur substantial costs associated with having to reimburse their banks for the monies that they the bank (unconditionally) had to pay out on their principal’s behalf. This is not to mention the additional costs and expenses that the contractor, shipper or charterer would incur to pay their suppliers and other customers.

While the above list is by no means exhaustive, it does illustrate the importance of proactive hands-on risk assessment due diligence, risk quantification and risk monitoring. The management and mitigation of geopolitical and counterparty risk in commodities trade finance supply chain management cannot be overlooked. Given today’s fragile geopolitical and economic environment, TDI’s time has come and will play an essential role in terms of how companies manage their supply chains.

Author: Edward Miller

Chartered Brokers Group is a Mauritius based speciality risk and insurance services firm serving both corporate and individual clients on the island.

With the firm’s recent addition of a speciality International Division, this practice is devoted to providing fee-only based political risk management, credit insurance, risk & on-demand guarantees solutions as a program manager and administrator to support cross border trade and investment into, from and within the Pan-African and Frontier Markets.