Orbitt provides readers with an analysis of 45 transactions in H1 2020 that offers a cross-section of the continent’s current investment landscape. The information is gathered from interactions between these 45 companies and a selection of the 477 institutional investors and lenders registered on our platform.

These include banks, private equity funds, private debt funds and trade finance providers located on and off the continent that are actively seeking $5m-$50m investment and lending opportunities in Africa. We present a snapshot ranging across all sectors and including 18 countries on the continent.

70%

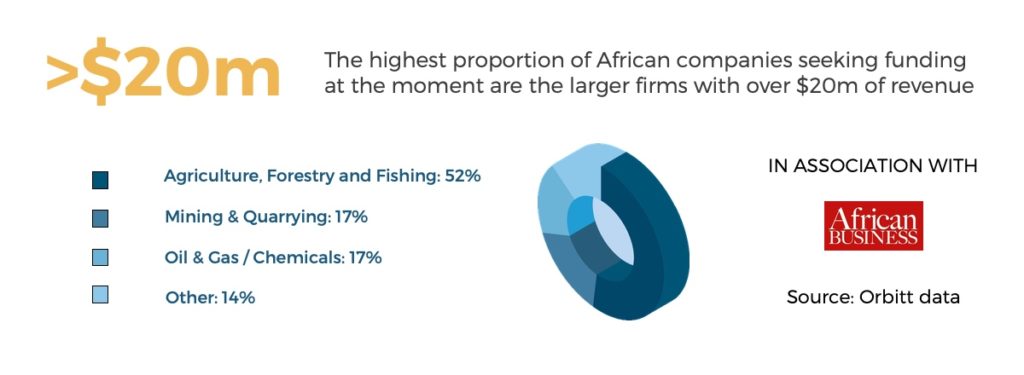

Analysis reveals that the current environment is geared towards hard and soft commodity-related firms in Agri and Metals & Mining, as opposed to the larger infrastructure deals (big tickets) or the smaller impact-led deals (small tickets and low revenue).

$1m-$5m tickets

Of the largest firms with a revenue profile of over $20m, 48% are undertaking debt or equity fundraising under $5m, which would qualify as a relatively small ticket size in relation to pre-Covid conditions.

The Orbitt perspective

Investors and lenders are putting a lot of focus on existing portfolio companies, and therefore appear to be looking at smaller tickets. This approach may suit a shorter-term view to test new market dynamics while still expand their coverage across the continent.