So you’ve built up your business to a stage where you have increasing growth opportunities and the capacity to raise debt funding. Or perhaps you’d like to sell your business to release equity and enable yourself to start doing the fun things you’ve always dreamed about. Either way, these scenarios invariably lead to two ultimate questions. Where do you raise capital and how do you find the right investors for your business?

The long road to finding an investor

The lengthy process of finding an investor is marred with complications. Ask any manager or owner who has travelled this journey, and they’ll tell you that it’s a time-consuming task that often involves answering questions such as:

• Which funds or institutions are best suited to your business needs?

• Where are these fund managers and decision makers located?

• Does the investor have similar businesses in their portfolio?

• How do I find out if they have a proven track record?

• Will I receive a long-term investment or can I access short-term funding for my trading activities?

After you’ve gone through all of these questions in your screening process, then comes the man-hours in organising your audited accounts. You also need to write a business plan, put your governance in order and populate your data room. The next decision involves which investment advisory firm to hire who can structure your investment opportunity and introduce you to suitable PE houses, Private Debt funds or Trade Finance banks.

Investor decision process

On the other end of the process, investors assess countless factors when deciding on which companies to invest in. These include elements such as the fund investment mandate, target investment size, geographic location, financial profile (revenue, EBITDA, profitability ratios, etc.) and background principals.

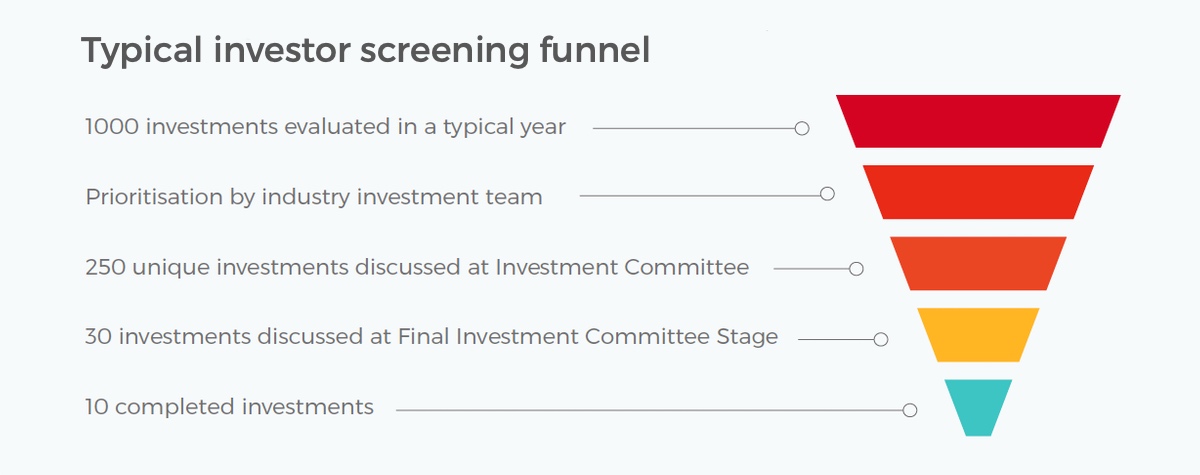

For equity transactions, as shown in the diagram below, on average only 10 out of every 1,000 investments evaluated by PE firms are completed as an investment. This then begs the question, how can you as a time-constrained manager at the crossroads of seeking an investor effectively search, identify and secure investment?

- Use smart algorithms: deal-matching platforms are able to simplify the process for you to assess your company’s vital information and match you with prospective investors who are most likely to be a good fit for your company or investment opportunity.

- Find the right service provider: service matching marketplaces are a one-stop shop for you to find the all-important financial services prior, during and after you secure investment. This might be a corporate finance adviser, insurance broker, foreign exchange trader or lawyer who has experience in your sector and geography.

Some of the advantages of using deal platforms include:

1. Efficiency

Deal matching platforms condense the laborious process of identifying, screening, selecting, and approaching investors from up a 6 to 8-week exercise to less than 20-minutes. By simply uploading details such as your company description, financial summary, location and type of investment, smart algorithms can recommend investors who are most likely to invest in your business or fund your trade. The recommendations are based on various factors including but not limited to the investor’s investment mandate, previous investments, ticket size preference and type of investment.

2. Wider investor base

How often do you get introduced to the same investment fund or are told about a bank that is a household name in the Africa investment community? The fact that there are over 1,000 investment firms who are interested in or have dedicated capital focused on Africa is often overlooked. On platforms like Orbitt, you are able to expand the universe of investors who get notified of your project. With a larger pool of investors, the probabilities of finding a genuine interest in your company and funding success are dramatically improved.

3. Investor screening

By having a wider investor base to select from, you’re able to screen investors based on the criteria you think is of most value to you. You can look at things like their past investments, the background of their core principals and directly compare investors to one another. Furthermore, you can select and connect solely with the investors you feel most comfortable with from the information that’s been provided. Suddenly, you’re no longer obliged to engage with an investor just because you’ve been introduced to them by a friend or an adviser.

4. Privacy and confidentiality

This is one of the cardinal principles of the investment process and the cause of most tension, especially in more informal societies across the continent. The number of hours spent agreeing on the wordings and execution of a Non-Disclosure Agreement (NDA) or Confidentiality Agreement (CA) can become a major frustration for managers. As a business owner, there’s also a high chance that you’ll end up signing numerous copies of these agreements with each investor you engage with. Having a system that automates this process can only mean efficiency. Orbitt, for example, has an automated NDA process that allows investors who are interested in your deal to simply click and accept the NDA terms before they are granted access to your confidential information.

5. Process and tracking

Like every other business process, the investment process requires a set of steps to be successfully completed before the next action can commence. When juggling day-to-day business needs, along with keeping on top of an investment process, business managers can often find themselves snowed under by the amount of work an investment process generates. Deal platforms offer an efficient task tracker, data room and notification systems which notify you of actions completed and outstanding, as well as what is due when and who it’s due to. This allows you to focus on your core business and only take action during the investment process when it’s needed.

6. Service providers

More often than not businesses need to procure the expertise of financial services providers before and during the course of an investment process. This will include a legal adviser, accountant and investment adviser. This can stretch across numerous other intermediary services such as insurance brokers, foreign exchange providers, tax advisers and corporate service providers. Rather than asking for a recommendation from a friend, Orbitt has built a marketplace for company owners where over 20 types of financial services providers across all sectors, geographies and funding types can offer their services to help you raise capital.