Africa is fundamentally a trading continent. The socio-economic structure of most African countries hinges on trade. Despite recent and concerted efforts to diversify economies, trade still accounts for 51 percent of Africa’s GDP according to World Bank data.

Banks, DFIs, traders and governments should recognise that adopting new technologies is a critical pillar to addressing the widening trade finance gap. By bringing a digital-first approach to how trade finance operates across the continent, all parties within the ecosystem can harness the value created through technological efficiency, particularly in a post-pandemic world.

Increasing access to trade credit guarantees

Given the various stimulus packages announced by African countries and multilateral finance agencies, there is a significant amount of capital seeking opportunities and yield across the continent. For this to find its way into the treasuries of African corporates and trading businesses, many barriers to accessing trade finance must first be removed.

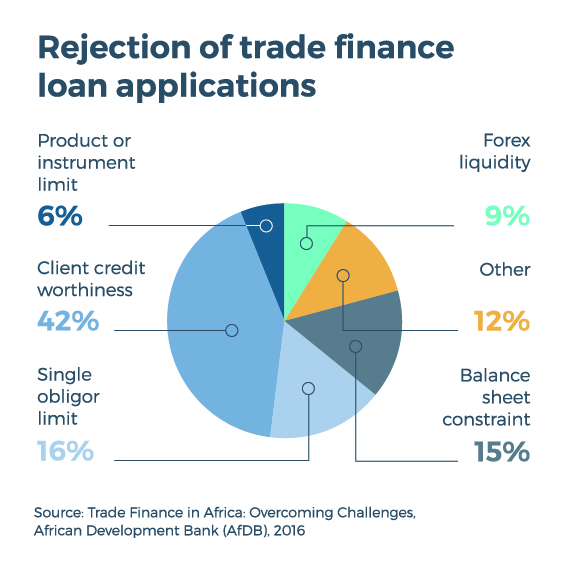

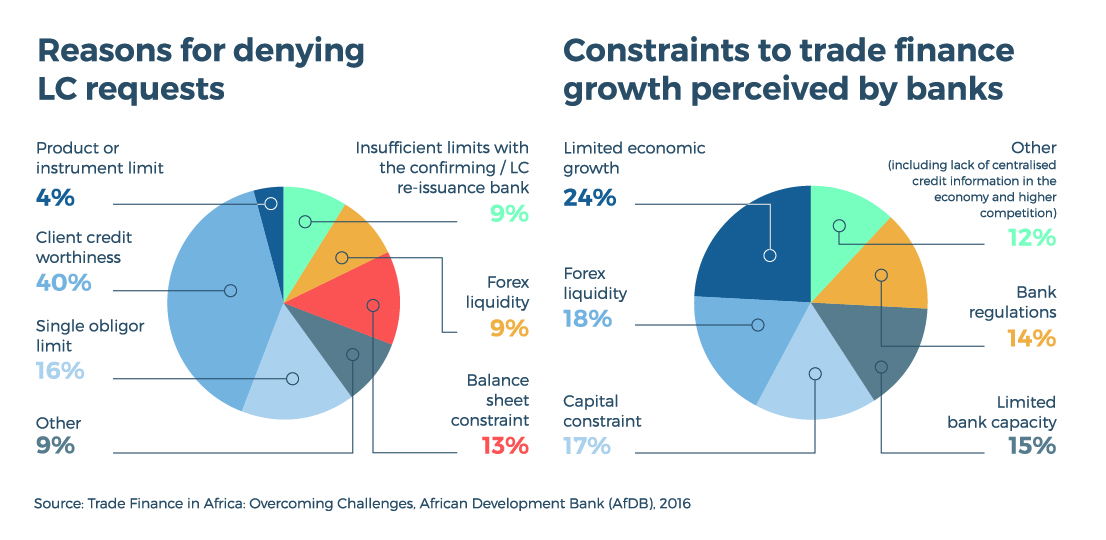

Smaller corporates that need access to trade finance – the lifeblood of Africa’s commodity ecosystem – are not always able to secure credit insurance or backstops which would otherwise provide lenders with confidence to provide funding. This is often the deal-breaker in many transactions. As a result, a significant number of companies are unable access the finance they need to grow their business.

One of the underlying reasons for this conundrum is the location of insurance companies, typically based in international markets such as London, Geneva or Singapore, and where there is often less risk appetite for Africa trades. Moreover, these market players are often unable to extend cover for smaller transaction sizes.

This passes on the baton to local and Africa-based insurance providers who must fill the credit insurance gap but lack the capacity due to international cover restrictions. Faced with a dearth of guarantees, the lack of credit-worthy SMEs in turn exacerbates the continent’s growing trade finance gap.

Supernodes to the fore

There are a number of specific solutions to ease limits on credit guarantees, but the onus should fall on multilateral institutions to take the responsibility and assume the role of ‘supernodes’. The best-placed organisations to do this are the finance ministries of African countries in conjunction with Development Finance Institutions (DFIs) because they are inherently development focused.

These actors have the sufficient scale to coordinate trade guarantees and invest in technologies that can help them attain the penetration that makes hitherto “uneconomic SME transactions” bankable. As a by-product of increasing access to shared financing instruments and collateral information, the network will be able to help its individual participants reduce their risk for future transactions.

Aggregation and technology

With wholesale aggregation and efficient technology, the pain points in pooling under-funded African SMEs would be minimised and give international credit providers access to more opportunities. In turn, the eventual lenders would be able to lower their origination costs without taking on additional credit risk.

Supernodes such as Africa Trade Insurance (ATI) and Africa Export-Import Bank (Afrexim) are one-stop partners that can provide cover for trades which meet a specific scoring threshold. This would provide lenders, either banks or funds, the confidence to take on the risk and distribute at a much faster pace.

Up until now, the ability of lenders to execute transactions efficiently and at scale has been a blocker. Collaborative technologies that enable a free flow of data and information do exist on a small scale, however, these multilaterals can unlock many more transactions at an aggregated level. The economies of scale from aggregation makes smaller size deals an attractive proposition.

Such an approach can encourage lenders to provide more liquidity at a better risk-return profile. In addition, reduced transaction cycles and faster credit committee approval times (from several months to several weeks end-to-end) will make African trading businesses more attractive in comparison to their Swiss, Indian, Singaporean or UAE counterparts.

Don’t forget the data

The current deficit in accessible company information and credit history data is a challenge for funders. As more data and credit information on African businesses is made available in an intelligible form to banks and alternative lenders – via credit guaranteed portfolios – the gap between perceived and actual risk starts to narrow and more funding can be made available to these enterprises.

The more established players like Moody’s are building out valuable pools of information for the industry, but there remains an opportunity for credit scoring engines to be integrated within existing networks.

This would allow companies to improve their access to funding and grow their trade volumes by reducing transaction risk through pre-qualifying for guarantees. The overall effect is to boost intra-Africa trade.

New concept, existing technology

The technological tools needed to achieve smart trade guarantees are readily available. These include:

- Collaborative aggregation: the ability to collect information reliably through platforms and portals

- Distribution: a centralised location where lenders can deploy capital to assets via a secure credit guarantee system that runs through the whole value chain

- Data: a confidential information highway which organises and enriches transaction and company data

An economic area is no longer defined by traditional boundaries, rather by digital data flows. As the African Continental Free Trade Area (AfCFTA) gathers pace, industry leaders must recognise that Africa needs to digitise its Free Trade Area to enable it to achieve scale.

With technology as a driver and institutional support as a mechanism, Africa has the chance to set the pace for the future of trade across the world.